ev charger tax credit 2021 california

Hey Californians so youve decided that you wanted to switch to an electric car. Residential installation can receive a credit of up to 1000.

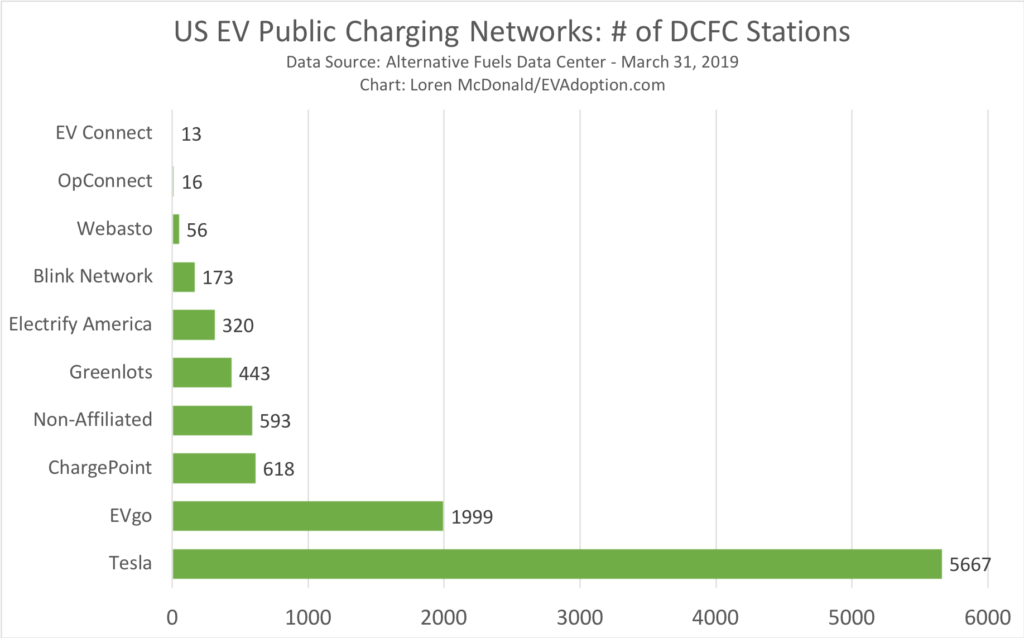

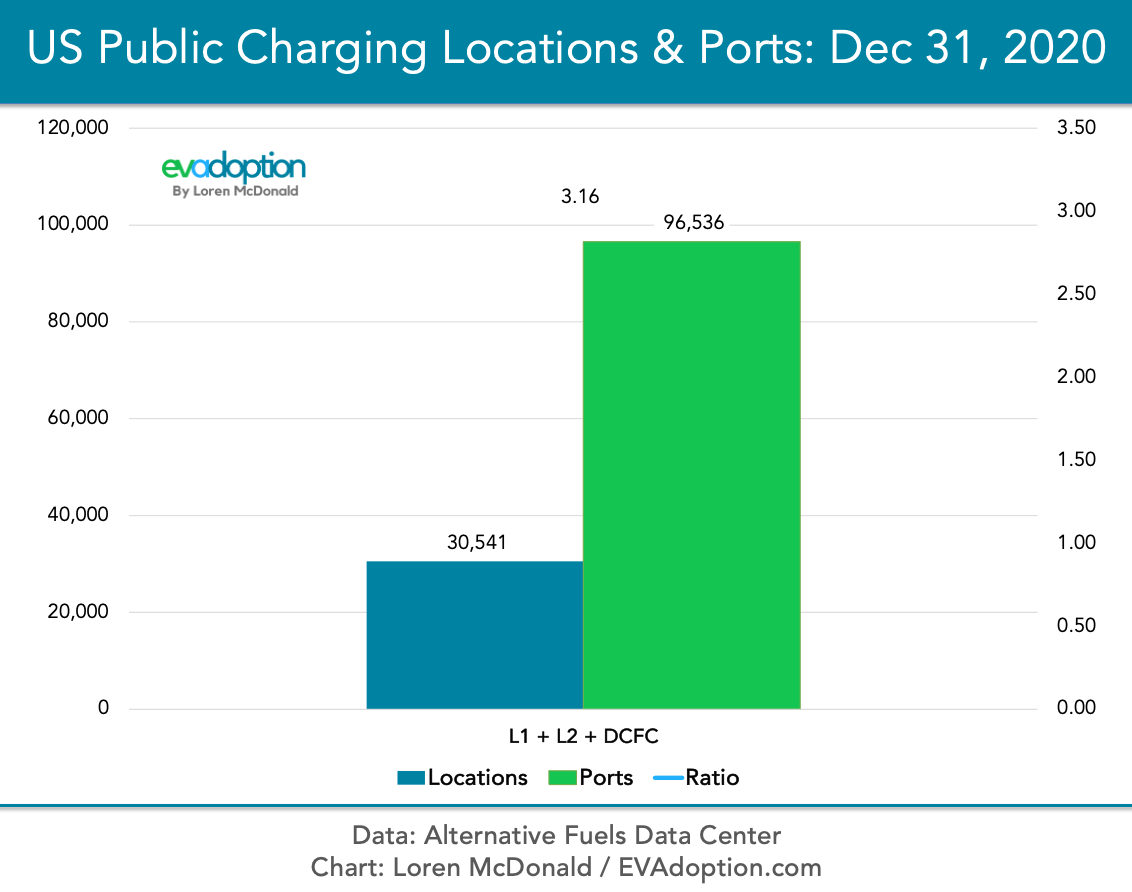

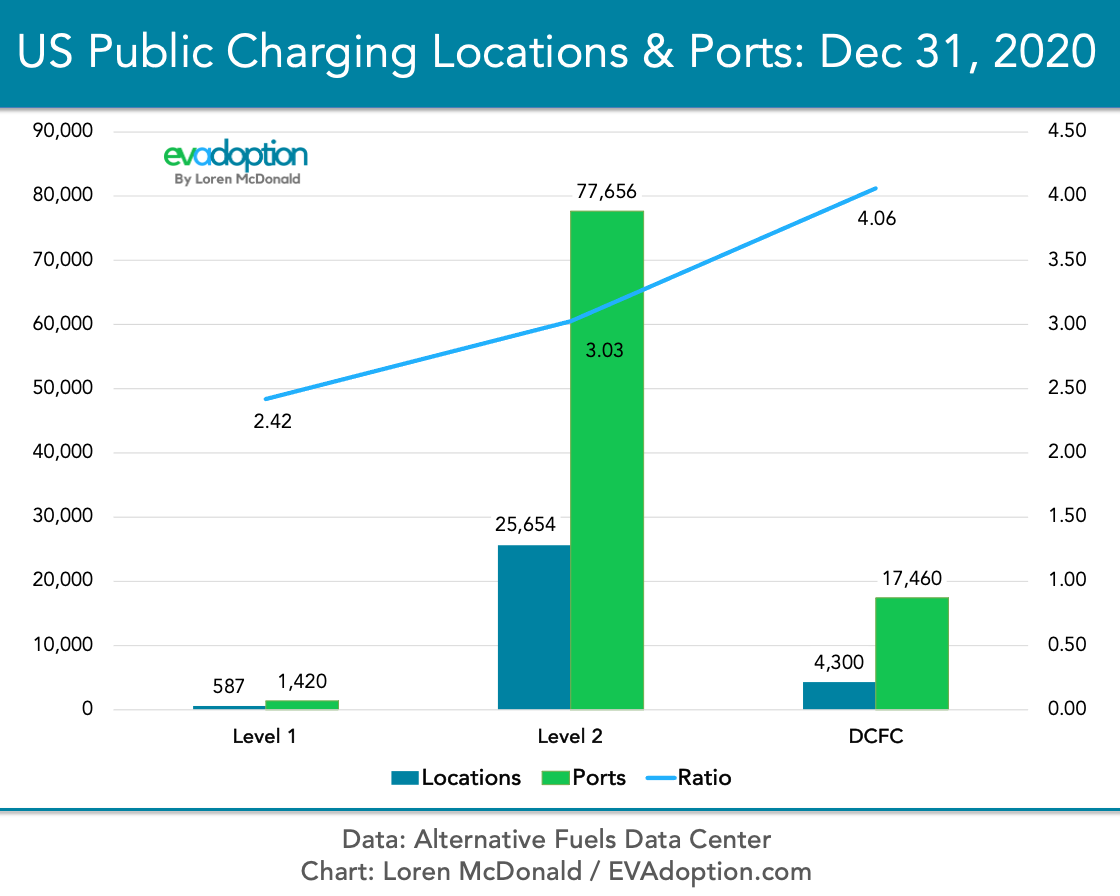

Dc Fast Charging Statistics Evadoption

The tax credit now expires on December 31 2021.

. The tax credit is retroactive and you can apply for installations made from as far back as. Purchasing an EV Charging Station in 2021. With TurboTax Its Fast And Easy To Get Your Taxes Done Right.

It covers 30 of the cost for equipment and installation up to 30000. Congress recently passed a retroactive federal tax credit for those who purchased environmentally responsible transportation including costs for EV charging infrastructure. The Taxpayer Certainty and Disaster Tax Relief Act of 2020 extended the alternative fuel vehicle refueling property credit to cover such properties placed in service in 2021.

A federal tax credit is available for 30 of the cost of the charger and installation up to a 1000 credit means 3000 spent. The federal 2020 30C tax credit is the largest incentive available to businesses for installing EV charging stations. Get Your Max Refund Today.

Residents who buy qualifying residential fueling equipmentincluding electric vehicle charging stationsbefore the end of the calendar year might be eligible for a tax credit of up to 1000 see IRS Form 8911 for additional information. Dont Forget About The Federal Electric Vehicle Credit. And April 7 2021.

Combined with the CA incentives your savings could be huge. See the IRS guidance Download the IRS form Talk to an Expert About Business Charging Save Up to 1000 on Charging Your EV at Home. Purchasers of the report will also receive the raw data in an Excel file.

Beginning on January 1 2021This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. To qualify you must be a site owner or their authorized agent and be a business nonprofit California Native American Tribe or a public entity. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US.

This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. You might also qualify for up to a 7500 tax credit from the federal government. The San Joaquin Valley Incentive Project offers rebates of up to 3500 per Level 2 Charger and up to 70000 per DC Fast Charger.

Additional tax credits are available through December 31 2021 for the purchase of fuel cell electric vehicles FCEVs zero emission motorcycles ZEMs and EV charging equipment. Maximum credit amounts are 8000 for FCEVs 2500 for ZEMs 1000 for residential EV charging equipment and 30000 for commercial EV charging equipment. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

To qualify for the credit the property needs to be operational in the tax year and used predominately inside the United States. Californias Electric Car Incentives 2021. State-based EV charger tax credits and incentive programs vary widely from state to state.

SUBJECT Electric Vehicle Charging Credit SUMMARY The bill provides under the Personal Income Tax Law PITL and Corporation Tax Law CTL a 40 percent credit for costs paid or incurred to the owners or developers of multifamily residential or nonresidential buildings for the installation of electric vehicle. If so we have great news for you. If your business has multiple locations you can.

You can receive a tax credit of up to 30 of your commercial electric vehicle supply equipment infrastructure and installation cost or up to 30000. Beginning on January 1 2021. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US.

EVSE must be installed between May 1 2020 and April 30 2021. Electrify America California CorridorUrban Q3 2021 EV Charging Utilization Averages 48 Per Port Charger Analysis of the Electrify America Q3 2021 Report to California Air Resources Board reveals an average utilization rate of their DC fast charger highway corridor and urban locations of 48. Have a question on the report before you buy send us.

Or maybe you already own an electric car and youre wondering what incentives you rate as an electric car owner. As of 2021 California Florida Texas and Washington account for more than half of all the EVs currently driven in the United States. Permitting and inspection fees are not included in covered expenses.

Rebate 1000 - 1500 California Vehicle Retirement Consumer Assistance Program The Consumer Assistance Program provides 1000 to 1500 to support the retirement of old polluting vehicles. Get more info on the Electric Vehicle Federal Tax Credit. For details including how to apply please visit SRP Business EV Charger Rebate website.

Funds will be awarded on a first-come first-served basis. Fueling equipment for natural gas propane liquefied hydrogen electricity E85 or diesel fuel blends containing a minimum of 20 biodiesel installed through December 31 2021 is eligible for a tax credit of 30 of the cost not to exceed 30000. Get Up to 30000 Back for EV Charging at Your Business Purchase and install your ChargePoint EV Charging station by December 31 2021 and your business may be able to receive a 30 tax credit up to 30000.

Well many EV owners are not aware of the benefits they can potentially rate for being an electric car owner. Receive a federal tax credit of 30 of the cost of. This report based on data from Electrify Americas Q3 2021 California report includes key findings analysis and 14 charts.

It applies to installs dating back to January 1 2017 and has been extended through December 31 2021. Electric Vehicles Tax Credit by Car Model Manufacturer. Here well outline some the state-based EV charger tax credit and incentive programs in each of these states as of.

SRP offers a rebate of 1500 per port for commercial workplace and multifamily customers who install networked Level 2 EVSE. Look Up California EV Incentives By Zip Code. Customers who purchase qualified residential fueling equipment before December 31 2021 may receive a tax credit of up to 1000.

The federal tax credit was extended through December 31 2021.

Rebates And Tax Credits For Electric Vehicle Charging Stations

Harris Unveils Plan For Electric Vehicle Charging Network Business News Us News

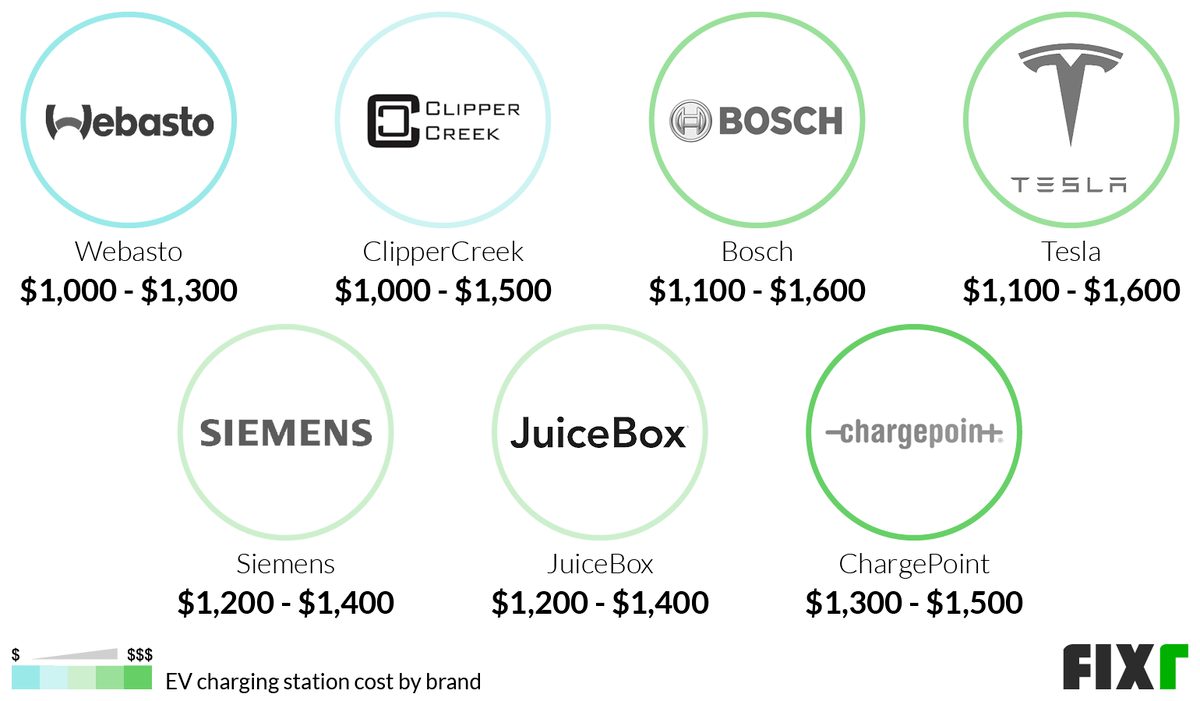

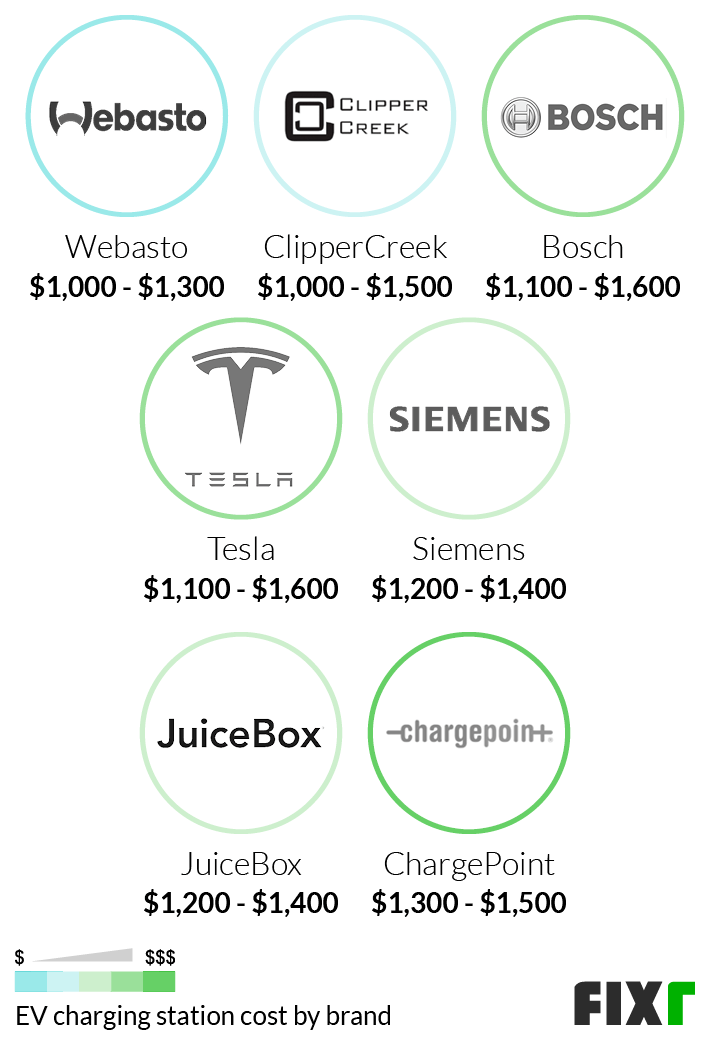

2022 Cost To Install Ev Charger At Home Electric Car Charging Station Cost

Electric Vehicle Charging Stations Market Global Report 2021

Guide To Home Ev Charging Incentives In The United States Evolve

Ev Incentives Ev Savings Calculator Pg E

Tax Credit For Electric Vehicle Chargers Enel X

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

2022 Cost To Install Ev Charger At Home Electric Car Charging Station Cost

/cdn.vox-cdn.com/uploads/chorus_asset/file/22633236/1232464562.jpg)

The Fastest Way To Get More People To Buy Electric Vehicles Build More Charging Stations Vox

States Get Go Ahead To Build Electric Car Charging Stations Kget 17

Here S Biden S Plan To Create 500k New Ev Chargers With Universal Standards

Ev Charging Statistics Evadoption

U S Ev Charging System A Priority Under Biden S 2 Trillion Infrastructure Plan

Plug In Electric Vehicle Charging Station Progress

Ev Charging Statistics Evadoption

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels